Mulesoft

Stripe

Salesforce

Habtamu Redie

MuleSoft Developer

Integrate Stripe and Salesforce Using MuleSoft for Real-time Customer Data Management

Mulesoft helps companies integrate easily with other business systems

Mulesoft is known to be one of the best integration platforms in the world. It helps simplify the integration process between various payment solution platforms such as Stripe and CRM technologies such as Salesforce, resulting in better customer data management and payment information. Real-time access to transactional data enables organizations to gain better insights on consumer behavior and improve operational performance. Integration with leading CRM systems such as Salesforce allows businesses to streamline their business processes and deliver superior customer experiences across channels.

Stripe is one of the popular payment service providers that allows businesses to process payments quickly and easily. It accepts dozens of payment methods such as card payments and wire transfers, among other forms of payments. Stripe supports one-time and recurring payment methods depending on business needs. A one-off or one-time payment is a single transaction, where the entire amount of the product or service is transacted. Whereas, recurring payments are transactions that are made repeatedly and periodically over a certain schedule, either with a fixed or flexible billing amount. Stripe provides merchants with flexible integration solutions depending on your business needs, without compromising the checkout experience.

In this blog, I will describe a step-by-step integration process between Stripe and Salesforce using MuleSoft to sync a newly created customer in Stripe to an Account Object in Salesforce.

To implement this integration, set up a Stripe and Salesforce account.

1. Stripe Account:

Create a Stripe account: Sign Up and Create a Stripe Account | Stripe

2. AnyPoint Studio:

Download Mulesoft: Download Anypoint Studio & Mule | MuleSoft (above v4.4.0 or later)

3. Salesforce Account:

Create a Salesforce account: Sign Up and Create Salesforce Account | Salesforce

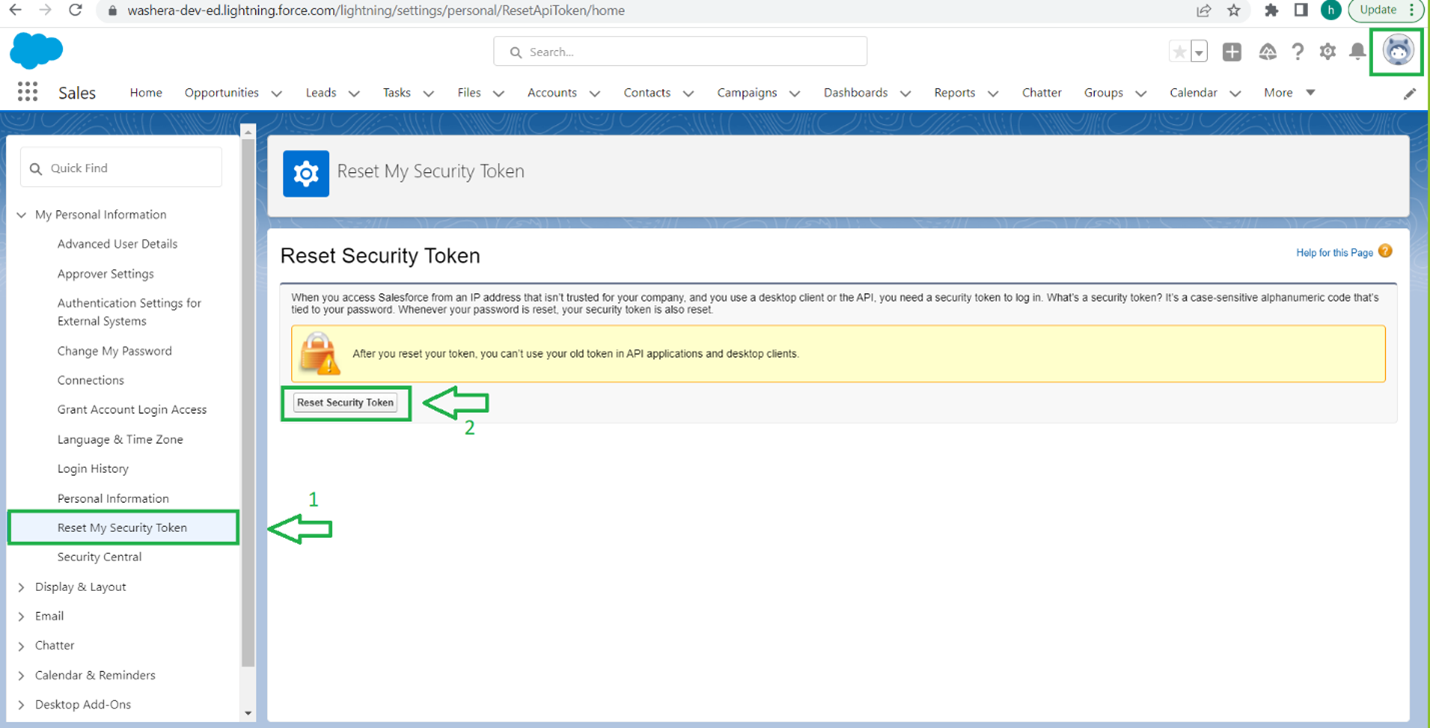

For the Salesforce Basic Authentication Connection, you will need to have a username, password, and security token. To get the security token, click on your Profile, then click on Setting then click on Reset My Security Token -> Reset Security Token (below screenshot for reference). After that you will receive the security token via the email address linked to your salesforce account.

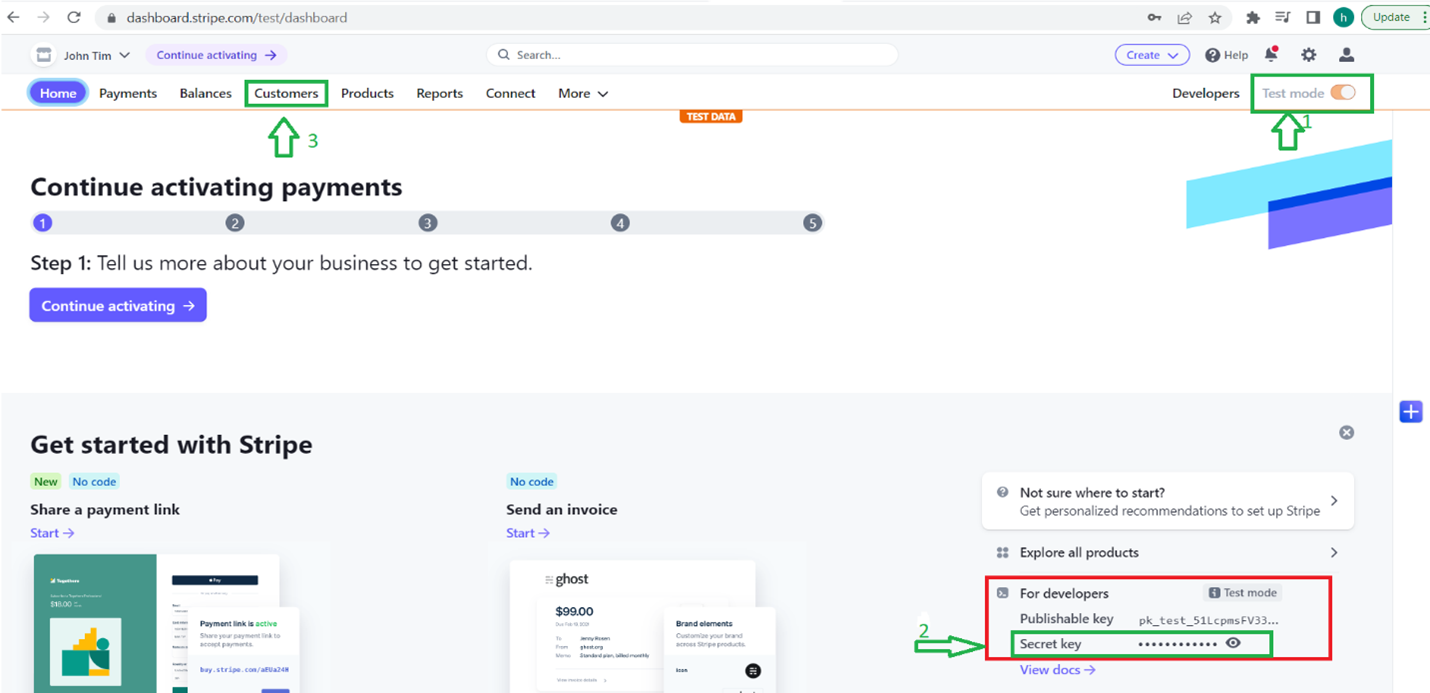

For the Stripe configuration, you will need the API Key. Copy the secret key as seen in the below screenshot and use it in the authorization section during Stripe connector configuration (to get the secret key refer to section 2 of the configuration). Make sure the test mode is enabled (if you activate payments, it’s auto-enabled by default).

Once you get the necessary information for the integration from Salesforce and Stripe, you can start the configuration.

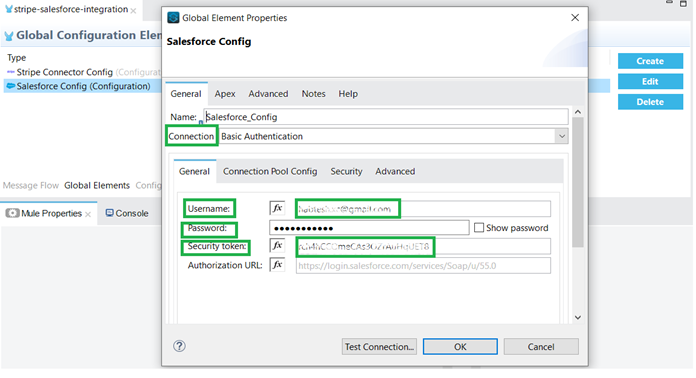

Salesforce configuration

Username: <salesforce username>

Password: <salesforce password>

Security Token: < token received on salesforce registered email Id>

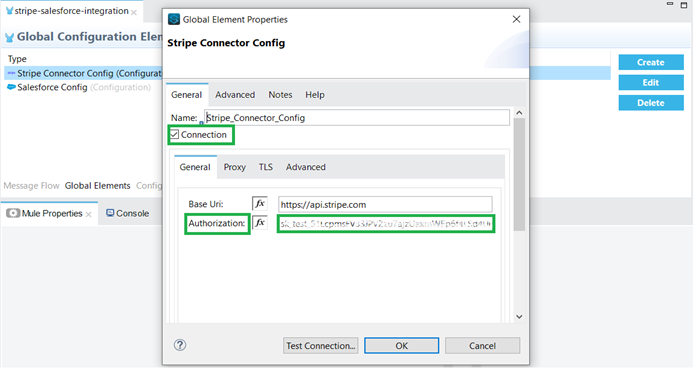

Stripe configuration

Authorization: < secret key from stripe account>

Note: Enable Connection checkbox.

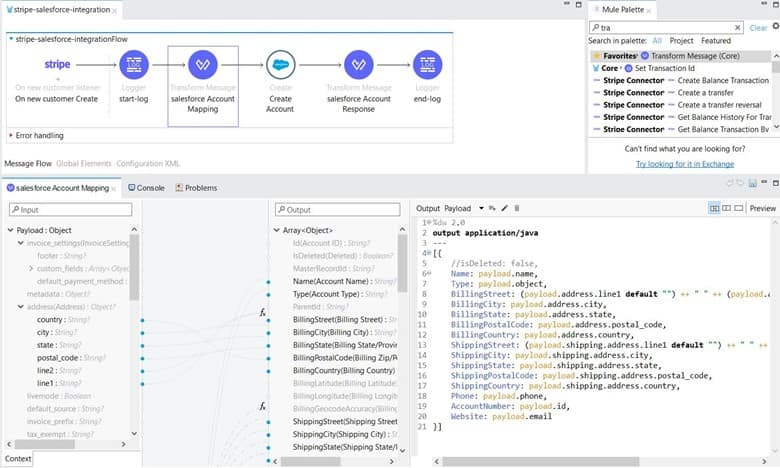

Now you can create a mule flow that will implement a data integration solution between the two systems in real-time. The mule flow will retrieve customer data when a new customer is created in Stripe and insert the data in Salesforce’s Account Object in real time. For this to happen, you need to do a proper data mapping, similar to the screenshot below:

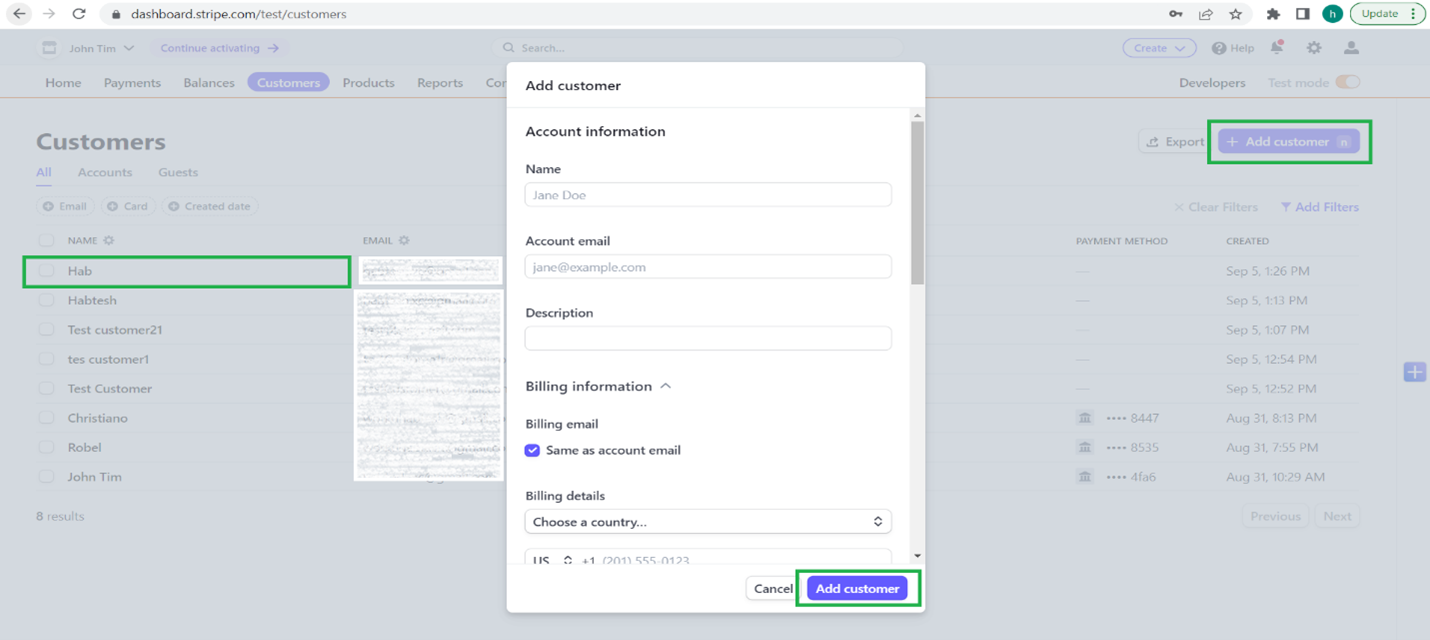

Deploy the mule application and create a new customer in Stripe following the below steps:

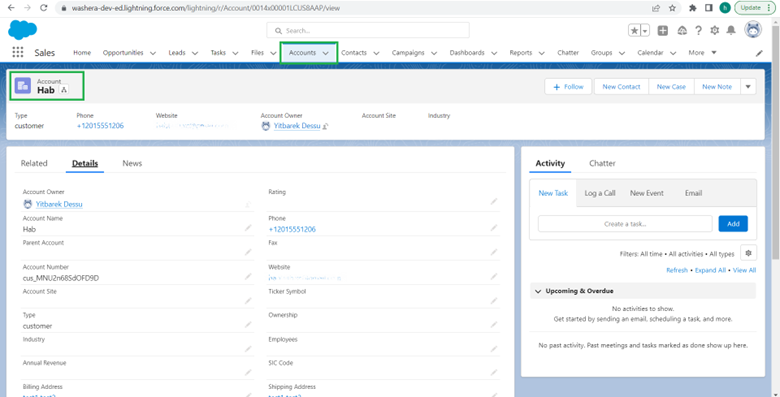

The below screenshot demonstrates how to insert the customer information in Salesforce’s Account Object using MuleSoft.

To sum up, this blog is to showcase the integration between Stripe and Salesforce using Mulesoft for better customer data management. MuleSoft provides a wide range of pre-built connectors found on Stripe or Salesforce, that you should leverage in your business scenarios.